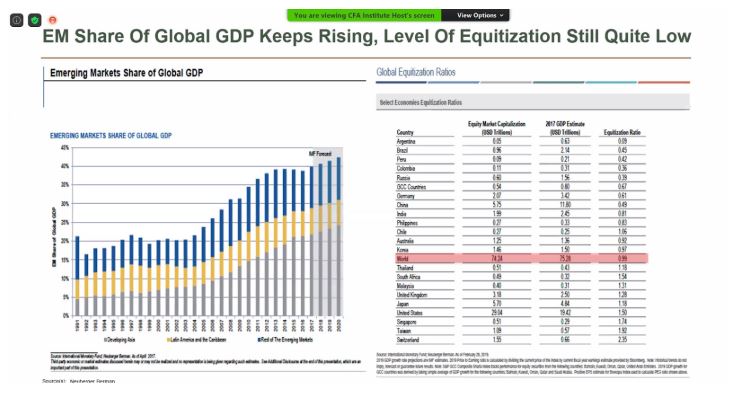

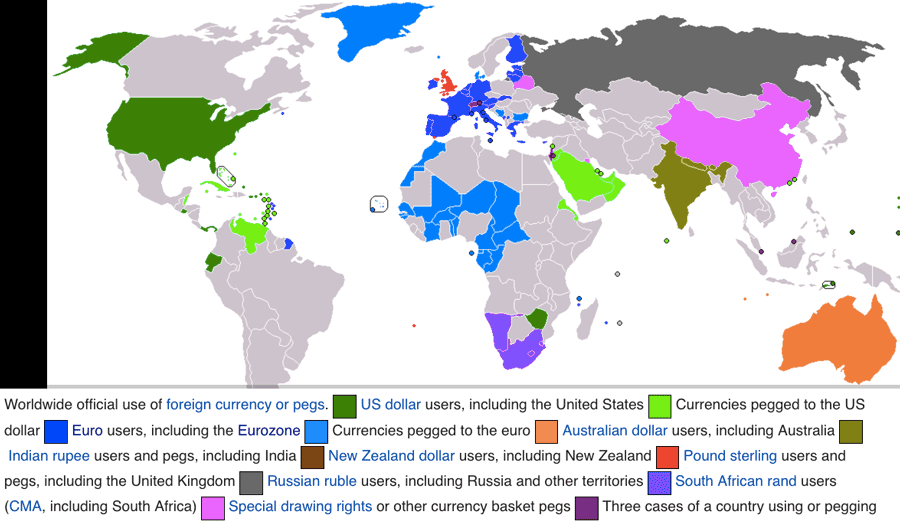

Traditional economic theory holds that crashing currencies have a self correcting mechanism. More expensive imports drive new demand for home made replacements, helping to boost the economy. Additionally, devolution makes exports comparatively less expensive for buyers abroad. Yet experience in a world where most trade is invoiced in dollars contradicts this idea, as a recent […]

Greenback Invoicing and Currency Risk