Currency substitution or “dollarization” is when a country legally recognizes the US dollar as legal tender, in place of or in addition to its own. Dollarization has many advantages for emerging market countries, according to a recent article in National Review.

By dollarizing, an emerging market country can eliminate exchange rate risk, and completely avoid currency crises. If they integrate their domestic banking system into the international system they can also naturally avoid banking crises.

Central banks create problems in emerging markets. Often they drive hot money inflows and credit distortions in their local economy. If an EM country dollarizes it avoids these problems. The banking system naturally adjusts.

Excess liquidity is deployed domestically if domestic risk-adjusted returns exceed those in the international market. It’s deployed internationally if the international risk-adjusted returns exceed those in the domestic market. This process is thrown into reverse when liquidity deficits arise…

Using Panama as an example, the article highlights several empirically demonstrated advantages of dollarization:

- Interest rates that mirror world rates adjusted for risk;

- Inflation risks lower than other emerging market countries;

- Stable exchange rates compared to other emerging market countries;

- Banking system resilient and not dependent on a “lender of last resort.”

That last point gets at some of the controversy of dollarization. Advocates of dollarization are often highly skeptical of Central Banks in general, especially those in emerging markets. According to the article, emerging market central banks “produce junk currencies, banking crises, instability, and economic misery.” Automatic adjustments might work better than an unreliable and capricious “lender of last resort”.

Yet economists argue that central banks, for all their problems, can provide a government with some advantages. If a country has unique domestic economic problems they might want to have an autonomous monetary policy. Of course in practice, this is often politicized, especially in emerging countries (and increasingly developed nations). Additionally, If a country dollarizes the government also forgoes seigniorage revenue which shows up as a profit. Politics also make it near impossible for a lot of countries to give up their own currency, which many might value symbolically. Usually it takes a major upheaval to make switching to dollarization palatable.

According to the IMF, dollarization makes the most sense for countries that are well integrated with the US economy. Most examples are in Latin America. Dollarization can make trade and finance links function smoothly. Economists can estimate tradeoff between forgone seigniorage, and lower exchange rates.

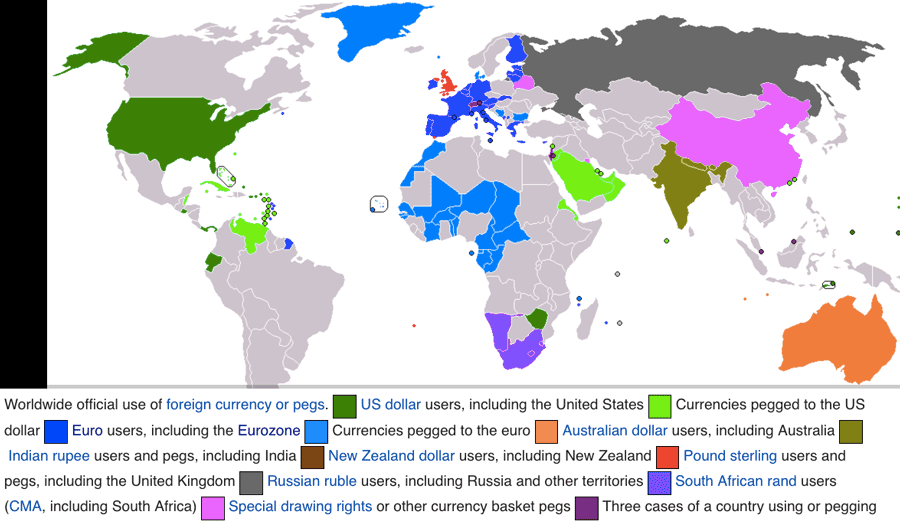

Currently 32 emerging market countries are dollarized. For example, Ecuador and El Salvador dollarized in 2000 and 2001, respectively. Perhaps the current geopolitical upheaval will lead more countries to consider this route

On the other hand, outside of Latin America many emerging markets are increasingly less integrated with the US. Further, using the dollar in transactions exposes companies to sanctions risk, the dollar seems less and less reliable as a store of value. Indeed there is some evidence that world trade is actually “dedollarizing”. Yet smaller emerging market could still benefit from some more stable medium of exchange and store of value. So it might make sense to create more regional currency blocks. Don’t be surprised if African and Central Asian countries start using digital Renminbi for major business transactions.