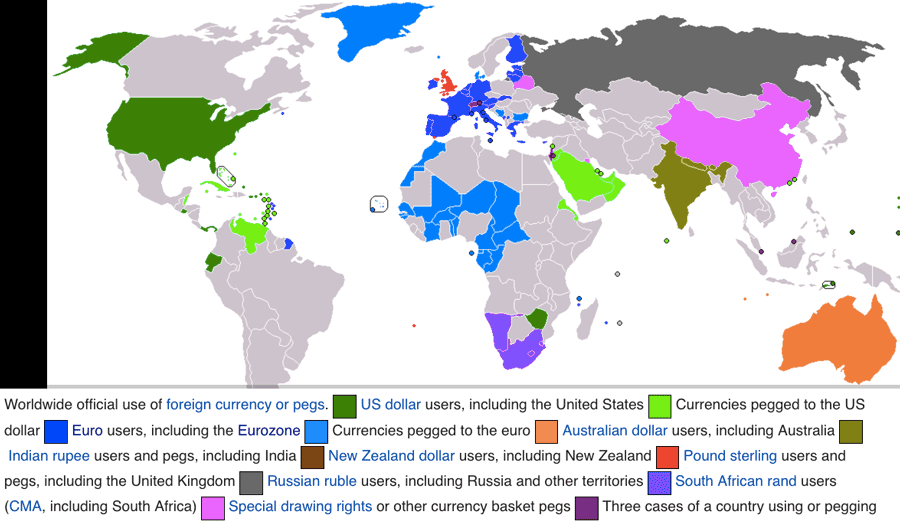

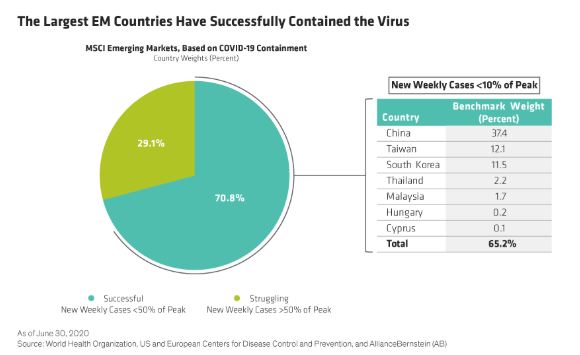

Modern Monetary Theory is becoming mainstream in developed markets. Governments are suddenly pursuing plans that lead to deficits that would have been unimaginable a decade ago. The US, UK, and Japan, for example are all engaging in record spending sprees to support the economy in the wake of Covid-19. Yet MMT has been slow to […]