EM/FM countries have unique growth prospects no longer present in the developed world.

Several secular trends support faster growth for EM/FM markets as a group. Demographically, EM/FM countries outside of China are younger, and family size is often larger. Nearly 90% of the global population under 30 is in emerging markets. According to research from McKinsey & Company, half of the world increase in consumption through 2025 is expected to come from emerging markets. Other sources have even more extreme estimates for further into the future. Forecasting is speculative- but one cannot support the idea that EM/FM countries won’t become more important economically in the coming decades without also forecasting a natural disaster that decimates the populations of these countries.

The rise of internet penetration from an exceptionally low base can also have dramatic impacts on the trajectory of an economy, creating new jobs and business opportunities. Partially due to the internet, education is improving in EM/FM countries. Even if public school systems fail to keep up, kids are able to learn important skills online. Basic coding skills go a long way to increasing salaries, driving the growth of a new consumer class.

These growth prospects do not appear to be priced in, broadly speaking.

What about Covid-19?

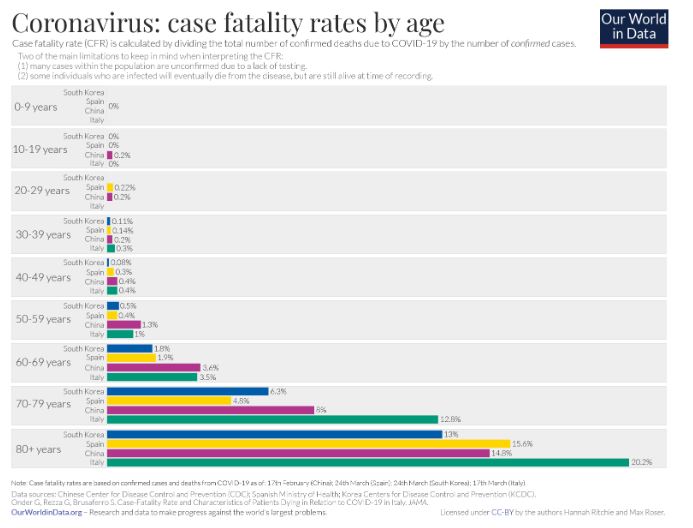

Coronavirus will certainly cause disruption to EM/FM countries, but it’s unlikely to reverse these favorable long term trends. Although there is a lot of uncertainty over the specific nature of Covid-19, one thing that is relatively clear is that it impacts old people much worse than young people.

Since the population in most EM/FM countries skews young, it is likely the long term demographic impact will be less severe than in developed countries. Of course, if the virus mutates so that it kills more young people (ie like the Spanish Flu in 1918 did), it would have a highly negative impact.

Additionally, since EM/FM countries typically have a much larger part of the population engaged in the informal economy, they are less likely to consider long term shutdowns a viable option. Although one can debate the merits of this approach from a humanitarian perspective, it is clear that opening sooner is likely to prevent economic catastrophes.

One key weakness of EM/FM countries that is being exposed by Covid-19 is debt. A reasonable case can be made that there will be major writedowns of both sovereign and corporate debt in the coming years. This is an unavoidable negative, although we can partially mitigate it by focusing on companies that meet a minimum balance sheet strength test. Additionally, on a relative basis EM/FM countries aren’t necessarily worse than developed market countries, which generally have higher valuations, and fewer growth opportunities.