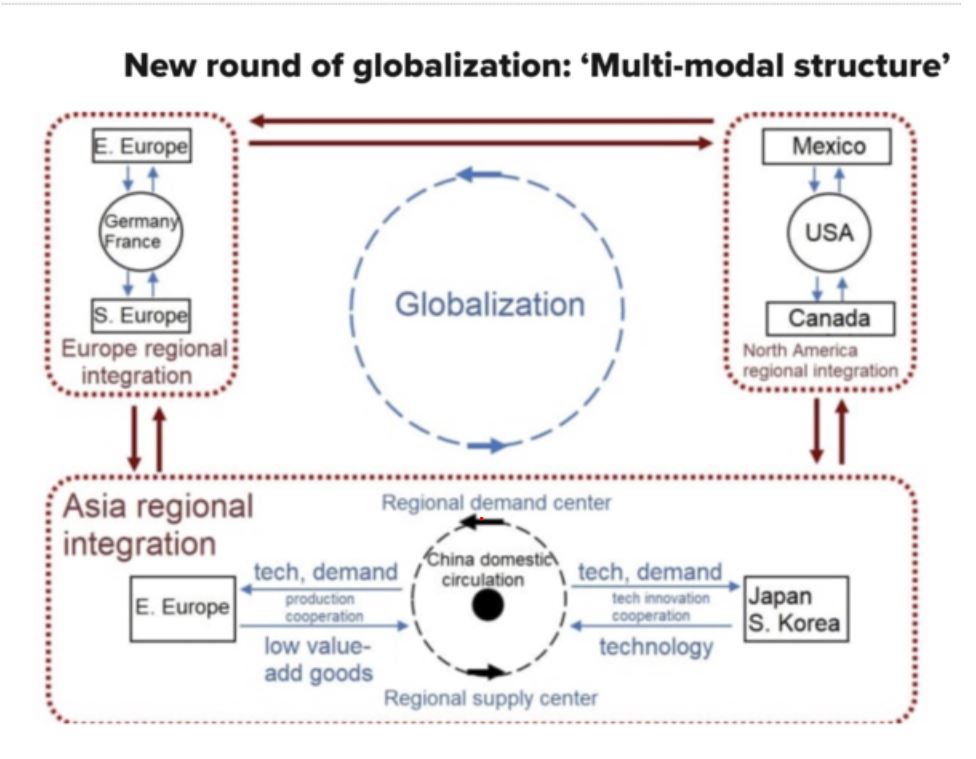

In May Xi Jinping introduced China’s “dual circulation strategy”. At first this passed without much comment, even from China insiders. However, seasoned China hands are starting to talk about the serious economic implications.Part of the reason this dual circulation strategy took so long to get attention is its vagueness. The specifics aren’t finalized yet, and […]