Yesterday the CFA Society hosted a webinar led by Mark Yusko, at Morgan Creek Capital Management: The Global Search for Alpha: All Roads Lead to emerging markets. Emerging market economies have experienced disruption of pandemic lockdowns, capital outflows, commodity price shocks, and supply chain disruptions. Policy makers have responded aggressively and creatively. It appears this policy response has been successful, leading emerging market economies to become more resilient than developed countries in coming years. Yusko is extremely bullish on Emerging Markets.

In the presentation, Yusko synthesized the valuation and asset allocation frameworks of GMO, Research Affiliates, and John Hussman. All of these frameworks point towards poor expected returns in developed markets. Investors face the “dilemma of high prices”.

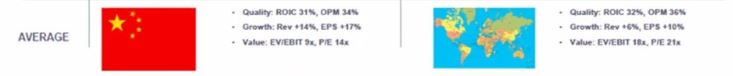

Emerging markets, however, offer “twice the growth at half the price” when compared to developed markets. This is especially true in China Yusko provided side by side comparisons of Chinese companies and their developed world counterparts in various industries including, consumer, healthcare, internet, media, and financial services. In each case the emerging market company was growing faster, and trading cheaper.

Here is a snapshot of the aggregate:

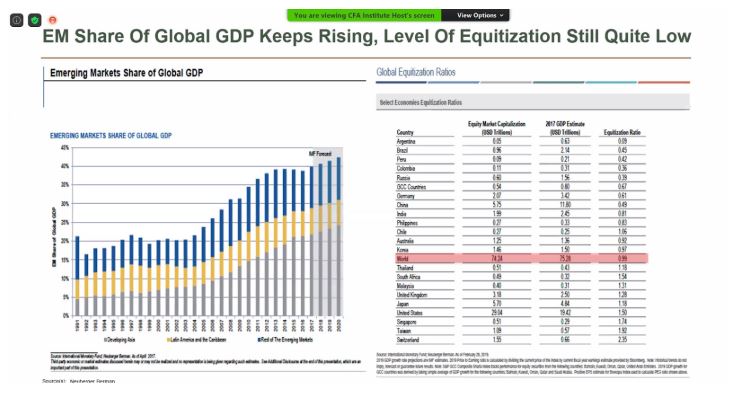

High GDP, low equitization

Emerging markets comprise an increasingly large share of global GDP, yet their equity markets remain comparatively small. This serves as a useful filtering mechanism to select the countries that are the best opportunity from a macro standpoint. Notably, Warren Buffett uses a similar heuristic to determine when the US stock market is undervalued or overvalued.

In the developed world, stock markets are already large compared to GDP. Yet in emerging markets, their economies are becoming larger and larger while their stock markets lag behind. When emerging market equitization catches up there will be major upside for early investors.

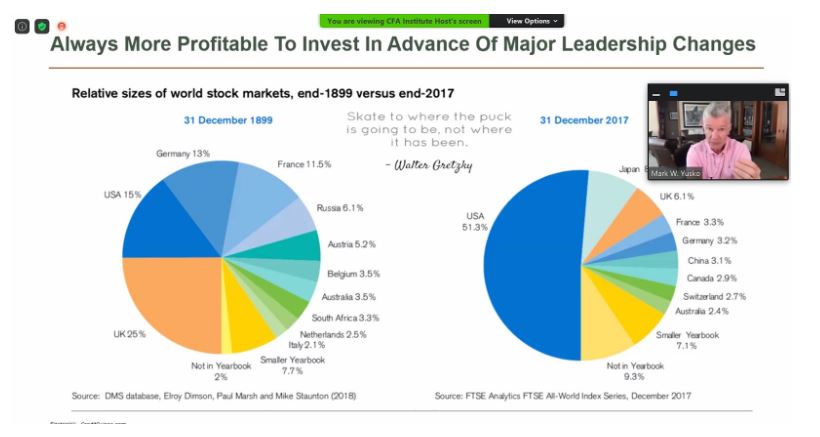

Skate to where the puck is going

Speaking of being early, Yusko emphasizes an extremely long term view. Remember the US was once an emerging market. The US stock market was relatively unimportant at the beginning of the 20th century. Now it dominates world market cap. The most profitable investments occur ahead of major leadership changes. Investing a large portion of your assets outside the US helps you get ahead of the next major leadership change.

Made for China, not in China

Yusko strongly recommends a focus on emerging market consumers. He highlighted three sectors: Consumer discretionary, technology, and healthcare. There are plenty of options in public markets of the first two, but getting healthcare exposure is hard because there aren’t that many public companies. His firm has a fund made concentrated investments into innovative companies mainly within BRIC(Brazil, Russia, India, China) countries that has outperformed emerging market indexes since 2005. He also recommended EMQQ as a good ETF option.

He also warned investors to be selective on countries, and avoid countries with weak currencies. A rapidly depreciating currency can be a major headwind for emerging market investors based in developed countries. By focusing on countries that have low equitization relative to GDP, and currencies that are already beat up, investors are likely to find a lot of opportunities for alpha.