Emerging and frontier market stocks are cheap, widely hated and underowned among institutional investors. Yet they represent a major long term opportunity. A macro regime change could lead to massive upside for investors who position appropriately.

As a group, EM/FM stocks typically have multi-year trends that are separate and sometimes directionally opposite from developed markets. Typically a macroeconomic regime shift marks the beginning of a trend reversal.

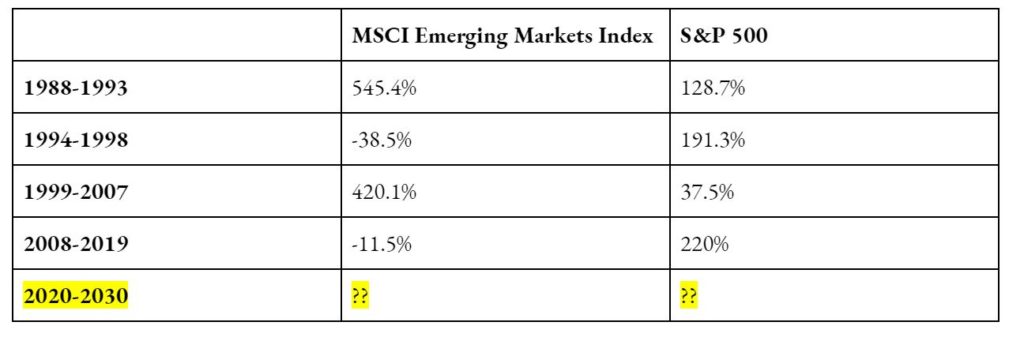

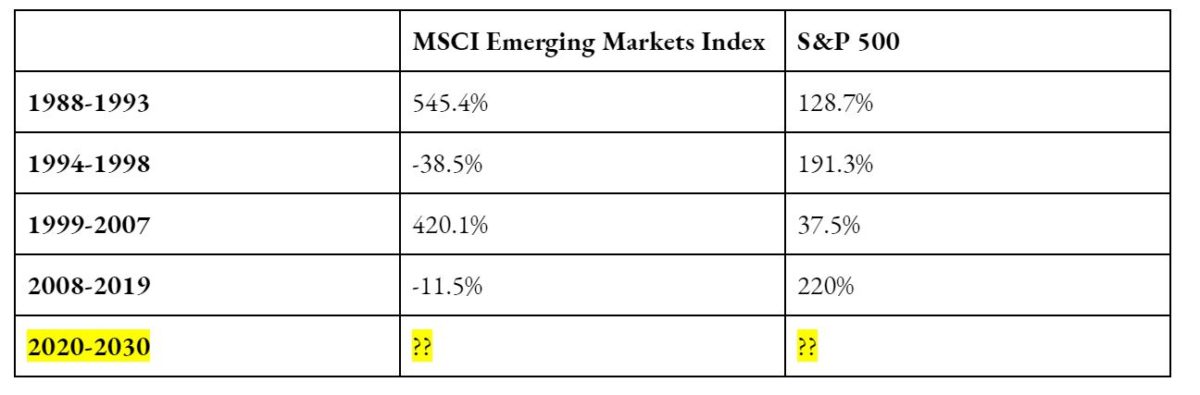

Here is a snapshot of different regime shifts, and the price returns going back to the 1980s.

For what it’s worth, regime shifts often occur after crises. Emerging markets performed horribly in the second half of the 1990s, but then had a dramatic resurgence starting in 2001, following the collapse of the US tech bubble. In contrast, US markets were broadly out of favor in the early 2000s. After the financial crisis this reversed and US markets have come to dominate global asset flows, while EM/FM and other countries languish. There is no guarantee that the Covid-19 crisis will lead to another regime shift but if it does, history shows there could be extreme upside for EM/FM stocks.

Three factors support the possibility of a regime shift towards EM/FM stocks: (1) Valuation (2) Fund flows (3) Growth potential. I’ll discuss each of these factors in subsequent posts.

One reply on “The Emerging Markets Regime Change”

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.