A lot of analysts are concerned that Covid-19 is going to devastate emerging markets. After all, they are less prepared to deal with massive demands on their domestic health infrastructure. Worse yet, a higher portion of the population in emerging markets likely lives in crowded conditions. This view is corroboratedd by recent stories showing a large portion of new cases are occurring in developing countries. Nine of the ten countries with the most new Covid-19 cases are in EM(the US has the distinction of being the only developed country on that list). India, Philippines, Indonesia, Brazil, Mexico, Chile, and Peru are all struggling to contain the spread. However, a closer look reveals wide variation in virus responses within EM countries.

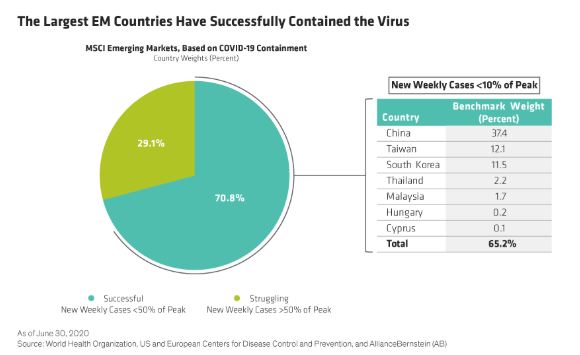

Although the struggling countries get the headlines, many major EM countries have done an excellent job containing the virus. These countries are the most significant EM countries by market capitalization. China, Taiwan, and South Korea alone account for 60% of the EM benchmark. Other EM success sotries sucha as Malaysian and Thailand have reduced their cases to 10% of the peak, and their stocks make up a significant portion of EM benchmark. As a result, the overall impact on EM indices is likely to be less bad than expected.

Alliance Bernstein referenced these success stories in a recent note:

If this success persists, these countries can begin the road back to normal and resume economic growth sooner than the US. And such countries may be fertile ground for finding EM winners, based on bottom-up research and risk/reward analysis on individual companies.

The note also had this chart, showing how Covid-19 success stories actually make up the bulk of the MSCI Emerging Markets index.

The countries that are succeeding at containing Covid-19 were succeeding economically already. A key driver of this success has been technology and changing consumer habits. These trends will accelerate as a result of Covid-19. Alliance Bernstein therefore recommends bottom up stock picking to take advantage of these key trends. As we previously noted, Covid-19 is unlikely to derail the growth trajectory of emerging and frontier markets.

Most of the opportunities they see are in Asia. Outside Asia there are still opportunities, but a challenging macro environment means stock pickers need to be more careful.

Nonetheless, a close look at the facts revealed Covid-19 isn’t as bad for emerging markets as originally thought. Investors need to look beyond the pandemic when evaluating opportunities.