Whether its war, terrorist attacks, populism or protectionism, investors can’t escape geopolitics. This is especially true for emerging markets, where politics sometimes matters as much as economics.

Geopolitical risk is becoming increasingly important. Trump has drastically altered America’s foreign policy. Radical populist leaders are rising around the world. Fiscal and monetary policy is increasingly intertwined. Covid-19 has heightened social instability around the world. According to the CFA Institute’s report on the Future State of the Investment Profession:

Geopolitical instability connects with social instability and produces deeper inequality fissures; negative feelings deepen around job fears, immigration, inequality, and getting a fair share of a nonincreasing pie.

Geopolitical Risk is Unavoidable

Many investors focus only on bottoms up analysis, and ignore geopolitical risk. However, this is unlikely to work in the future without taking geopolitical risk into account.

Here is how Teimur Hyat, PhD, the chief strategy officer at PGIM responds to those who doubt the importance of geopolitical risk:

. . . can you just ignore these near‑term geopolitical risks, because they’re too hard to predict? I think investors are increasingly discovering that you simply can’t afford to do that.

Investing in a Geopolitical Age

Let’s consider Brexit, where many of our clients were left scrambling to understand their true exposure . . . It’s easy to look at your direct UK equities holding, but what is your real estate holding? And do you indirectly have exposure to the UK economy through companies that may be earning a significant share of their revenues there?

We would argue not being able to understand your geopolitical exposures really puts the chief investment officer, or any investor, in a fairly uncomfortable position in terms of being able to speak to what their portfolio represents.

Embedding geopolitical risk in valuation is of course far from being a new idea. I would think most of the CFA charterholders would agree that looking at geopolitical risk in the emerging market context has always been important, which is why they look at sovereign credit rating risk, and why they have specialist analysts devoted to emerging markets.

Our extension of that chain of thought is that if the focus of geopolitical risk has expanded beyond emerging markets to developed markets, it’s only logical that in‑house asset allocators as well the third-party asset managers begin to shift their focus. Now they must also analyze new geopolitical risks from where they are emanating, which is increasingly developed markets.

Since investors can’t avoid geopolitical risk, they need to analyze it rigorously.

Analyzing Geopolitical Risk

The primary impact of geopolitical risk is to increase uncertainty. Consequently financial decision makers delay making major commitments. Companies reduce capital investment and new hires. Portfolio managers maintain risk off positioning. Capital allocators reduce the amount they invest into new funds. Consumers hold off on buying cars, houses, and other big ticket items, and even act more frugal in their day to day lives.

Schroder’s Global conducted empirical research into the imapct of geopolitics on different asset classes. Here is how stocks, bonds, and gold reacted during the Gulf War, 9/11 and the Iraq War.

As expected , geopolitical risk causes people to exit shares and invest in short term government bonds. Additionally investors hold gold in emergencies.

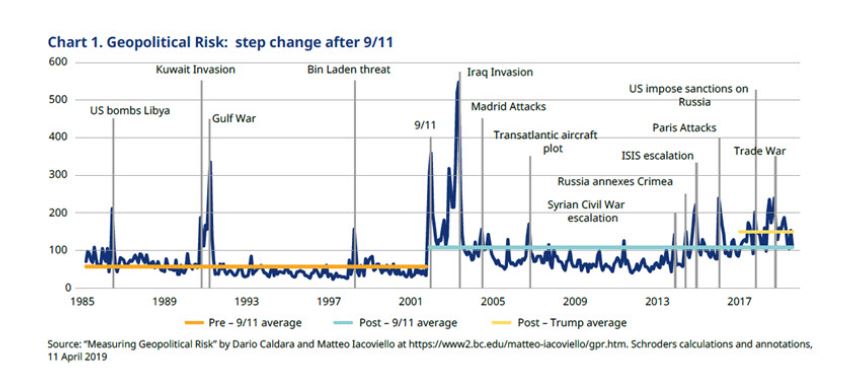

They also did a more long term review using their proprietary Geopolitical Risk Index (GPR). This index reflects automated text search results from the archives of 11 major newspapers, capturing mentions of key words such as “military tensions, “wars” and terrorist threats.

Although geopolitics in recent decades have not hindered long term returns, investors holding a risky portfolio during geopolitical events were forced to endure high volatility. To avoid this, investors need to be agile, shifting to safe assets as tension begins. This is impractical for most individual investors, but a key benefit of hiring professional portfolio managers.

Keith Wade, Chief Economist at Schroders added:

There has been a significant increase in geopolitical risk during the Trump presidency. The emergence of China as a global superpower and the rise of populism means this is unlikely to change soon. We have seen this in the recent breakdown of talks between the US and China: tensions between the two nations remain high and the GPR index remains elevated.

Analyzing geopolitical risk will be a critical challenge for emerging market investors in the coming years.