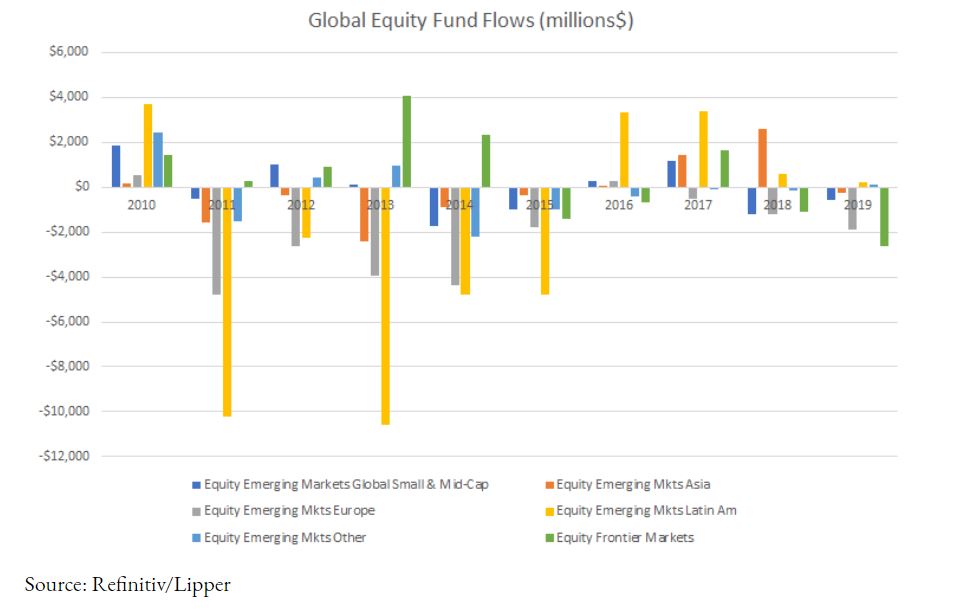

Over short and medium time frames, emerging markets are inevitably driven by capital flows as much as company fundamentals. Fund flows have been consistently out of EM/FM countries over the past decade.

Consequently, most developed world investors are underallocated to EM and FM stocks by any reasonable standard. GMO, which advises institutions on asset allocation, has noted institutions it has surveyed typically have less than 5% allocated to EM, even though their own models advocate more than four times that allocation. There is a lot of room for institutions to increase EM allocations, driving a major rerating in stocks.

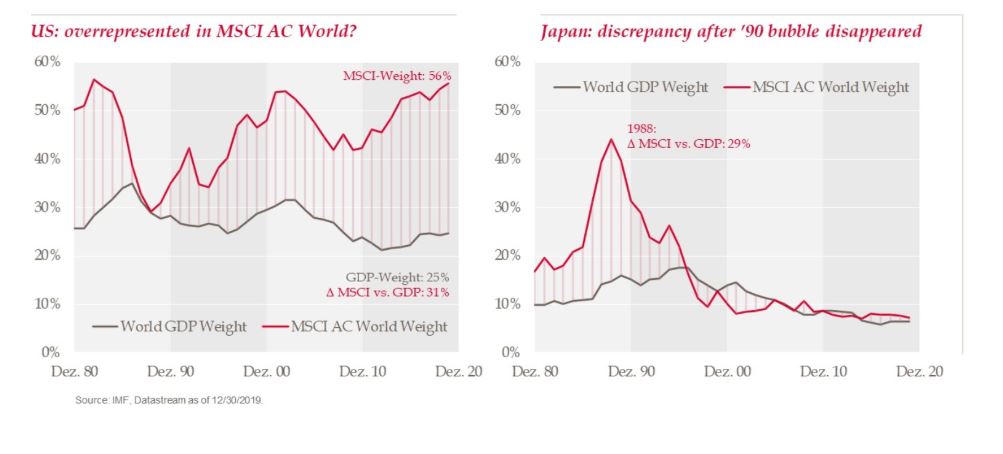

In contrast, investors are broadly more heavily invested in the US than is justified by its economic size. MSCI World Index drastically overweights the US relative to its % of global GDP. This is eerily similar to how much investors were overweight Japan at the peak of its bubble. Although it’s true that the US has bigger and deeper capital markets than the rest of the world, at the very least this mismatch seems to indicate there is a strong case for adding more non-US exposure. EM/FM markets are the most undervalued of the non-US markets.

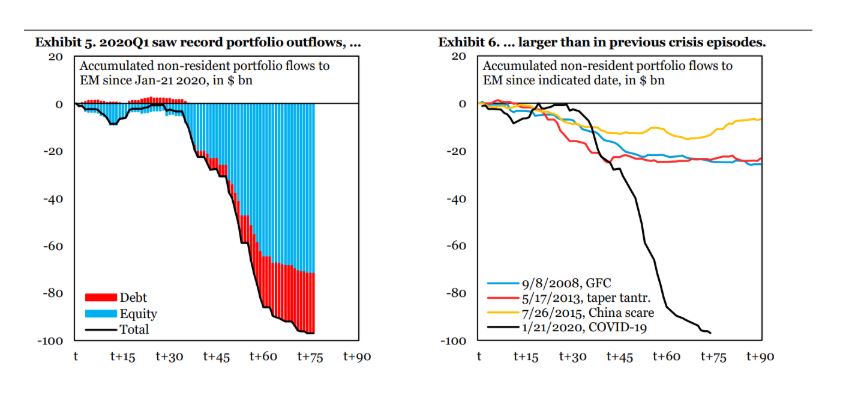

Covid-19 Outflows

Although investors started 2020 already underweight emerging markets. Outflows during coronavirus exceeded those of the 2008 global financial crisis.

Although these outflows have reversed partially in recent weeks, the overall effect of fund flows over the past decade has been mostly negative. If this were to reverse, EM/FM stocks would surge.

There is no guarantee that a mean reversion in valuation and fund flows will happen quickly. However, the risk/reward tradeoff does seem favorable, especially when you consider the growth opportunities in EM/FM countries.