Emerging and frontier markets have been broadly out of favor for over a decade, and are trading cheaply, however you measure valuation.

According to Morgan Stanley:

The 2010s were the worst decade for emerging stock market returns since the 1930s. When the coronavirus began to impact stock markets in mid-February, emerging markets were 18 percent below their long-term trend in absolute terms, while U.S. stocks were 19 percent above their long-term trend. When markets hit their lows on March 23 rd , both the U.S. and EM were down sharply, leaving the U.S. 22 percent below—and EM 44 percent below—their long-term trends. That low in EM has been matched only once since emerging market records began in the late 1980s, at the bottom of the bear market that followed the tech bust in 2001.

This chart shows the lost decade for the MSCI Emerging Market ETF(EEM), and MSCI Frontier Markets ETF(FM). It also shows how much US stocks (SPY) have gone up compared to the rest of the developed world (EFA) during the last decade.

Although stocks have recovered somewhat in the past few weeks, they are still cheap by historical standards. EEM is ~25% below its 2007 high. FM, which launched in 2012, is 40% below its 2014 high. Coronavirus notwithstanding, emerging and frontier markets have made a lot of economic progress in recent years, so it’s hard to justify these prices using economic fundamentals.

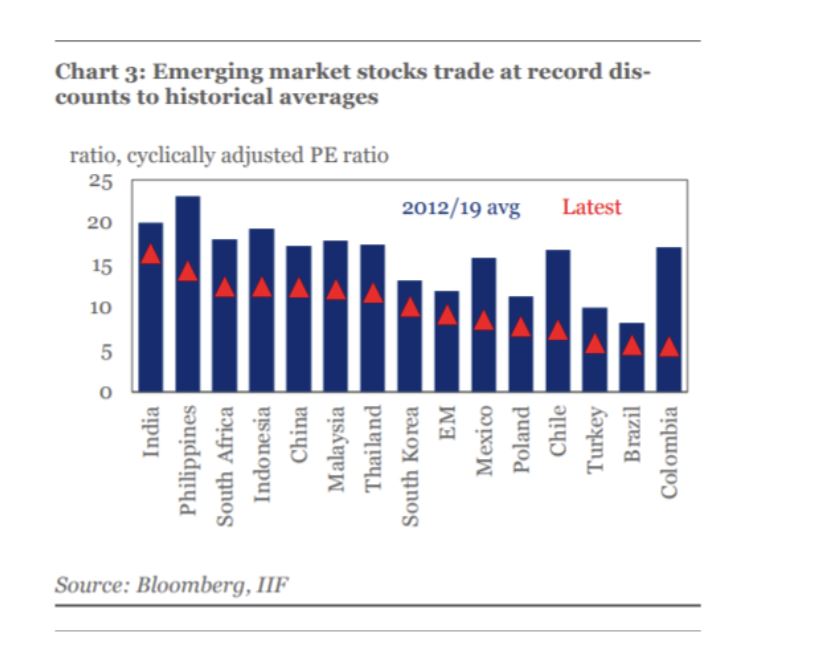

Across the board, EM and FM countries are trading cheap relative to their own historical average. Some examples:

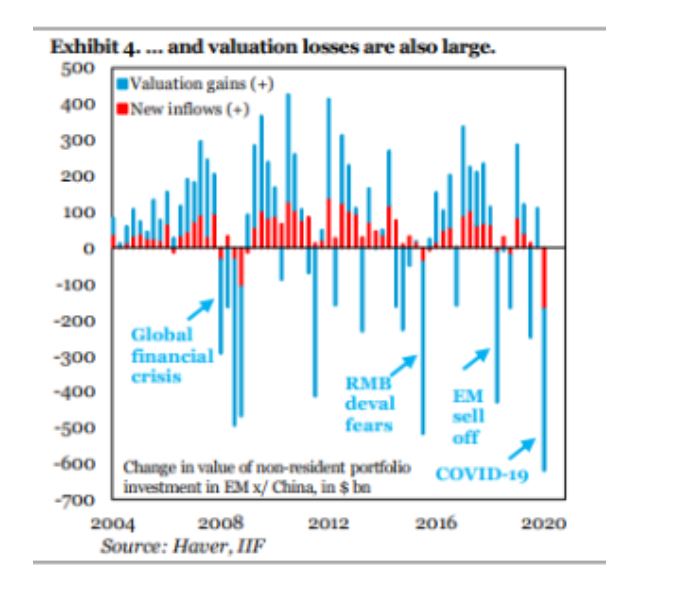

Although EM/FM started the year already cheap, valuation losses during the Covid-19 crisis have been more severe than during the 2008-2009 GFC.

A mean reversion for EM/FM stocks is coming.